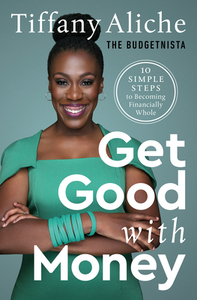

Take a photo of a barcode or cover

mirrandawrites's review

5.0

My favorite thing about this book was the author’s writing style. It felt like I was sitting down with her and a cup of coffee just talking about the ten steps in her book. Many books on this subject feel disconnected from the reader, and that’s not a bad thing, but her writing style makes this book stand out from others. I highly recommend it for anyone who wants gets to get their financial life together. My old lady self, Pearl, already thanks Tiffany (and her old lady self, Wanda.)

theblackfoodie's review

5.0

Great breakdown and step by step guide to becoming financially while...I'll definitely be revisiting as I need to make adjustments as I move thru life to ensure I live the financial life I desire

readbooks10's review

4.0

This was a pretty good personal finance book. Some things I liked were that when reviewing budget categories to cut the author suggests looking at things that provide safety or security (like rent or heat or groceries) as most important and other things as less so. She talks about going through your budget and thinking about how bare-bones you can go and calling this your "noodle budget," that is, your ramen-noodle-eating level. She has good basic information about creating a budget and emergency fund, looking for ways to add more income like with a side gig or starting a business, and talks about getting out of debt, investing, insurance, credit scores, and estate planning. She also does a good job of explaining how to automate accounts. The author, a former teacher, has a podcast and has done financial coaching. She admits to being conned out of most of her savings years ago and discusses how to avoid this type of thing and start over from financial setbacks without guilt. This is a good, up-to-date guide.