Take a photo of a barcode or cover

122 reviews for:

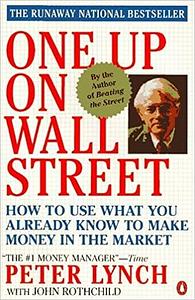

One Up on Wall Street: How to Use what You Already Know to Make Money in the Market

John Rothchild, Peter Lynch

122 reviews for:

One Up on Wall Street: How to Use what You Already Know to Make Money in the Market

John Rothchild, Peter Lynch

Before picking up this book, I had only heard about the stock traders who made it big - from Warren Buffett to Rakesh Junjhunwala. One question which plagued my mind was - how can a layman compete with some of the smartest brains, who spend their entire lives analysing companies and picking the best stock. The author firmly believes that one can very well make it big - all you need is a more focused approach. By putting in only a few hours every week, one can do adequate research by simply going through the financial reports, keeping oneself up-to-date about the recent trends in our globalised market and keep a calm head.

For someone who isn't well-versed with the stock market jargon (such as P/E ratio, dividends, futures, etc.), one might have to consult other resources to fully understand them. The author gives a high-level overview but in some cases, it might not be enough.

The advice is straight, to-the-point and unambiguous. The author mentions not only his biggest home run but also the stocks which slipped under his radar or stocks which were bad choices in retrospect.

I'm not sure if all the advice is relevant to today's markets, considering the fact that it was written almost 30 years ago. But for someone planning to start out, I'd highly recommend it!

For someone who isn't well-versed with the stock market jargon (such as P/E ratio, dividends, futures, etc.), one might have to consult other resources to fully understand them. The author gives a high-level overview but in some cases, it might not be enough.

The advice is straight, to-the-point and unambiguous. The author mentions not only his biggest home run but also the stocks which slipped under his radar or stocks which were bad choices in retrospect.

I'm not sure if all the advice is relevant to today's markets, considering the fact that it was written almost 30 years ago. But for someone planning to start out, I'd highly recommend it!

This book is a gem for the people who wants to invest into a company rather than just buying and selling stocks. It is for beginners, doesn't contain strategy kind of things.

It is a heavy read for me. But, the people who are into fundamental analysis will love it and finish it easily.

Personally, I couldn't relate to the many U.S companies that is been mentioned in this book.

It is a heavy read for me. But, the people who are into fundamental analysis will love it and finish it easily.

Personally, I couldn't relate to the many U.S companies that is been mentioned in this book.

It's cool if you're beginning from scratch but 60% of the stuff is irrelevant now.

Funny, insightful, actionable. Interesting that so many of the market irrationalities we see today was present back then as well. I guess human nature don’t change.

hopeful

informative

reflective

medium-paced

After reading Steve Jobs biography I’ve really focused on intuitive leaders and intellectual ones. For me, Peter is an intuitive leader. He doesn’t get fixated with silos and instead manages what he can.

I can definitely see some arguing this book being dated but I think this book still holds great insight. His efforts go towards keeping it simple.

Helpful advice I took: Cash flow statements, PE compared to growth rate, debt to equity ratio, story stocks and how to better categorize a stock.

The back of the book also has a broken down detailed summary of everything taught. Easy to look back to for reference.

I can definitely see some arguing this book being dated but I think this book still holds great insight. His efforts go towards keeping it simple.

Helpful advice I took: Cash flow statements, PE compared to growth rate, debt to equity ratio, story stocks and how to better categorize a stock.

The back of the book also has a broken down detailed summary of everything taught. Easy to look back to for reference.

informative

reflective

medium-paced

challenging

funny

inspiring

lighthearted

reflective

fast-paced

If you want to know how to point out multibaggers, this provides a good to the point refrence.

Few timeless lessons along with some outdated concepts. Short, crisp, to the point.