Scan barcode

simonator's review

informative

fast-paced

4.0

Digestible and well-presented, so that you don't have to be 1000% switched on every time you read it. Incredible statistics and clear-sighted policy suggestions - mosty. Some are a bit strange and could benefit from some more pages.

es_blackwood's review

challenging

informative

fast-paced

4.5

screaming and crying thinking about the US capital taxation system

catincaciornei's review

5.0

Interesting, narrowly focused on inequality, practically an annotated research paper with heavy use of statistical models. First of all, it's important to mention that a 5-start rating system such as this on Goodreads is superficial; it doesn't allow expression of the shades involved in reading, understanding and reviewing a book. My 5-star rating here shows nowhere near the enthusiasm I held for other books before; but how to review otherwise an in-depth eye-opening game-changing study into one of economy's hottest subjects? This was not an easy book to go through, not because the explanations were difficult (they were not) or the language complex (it was not), but because it was sometimes tedious and repetitive (like I said, a research paper). It's likely quite sterile for an outsider to the economic field; even connections to policy are few and far in between. But I've been warranted that the statistical models used are some of the most complete ever put together, and Mr. Milanovic is an authority in this succulent field of inequality studies.

wilte's review

4.0

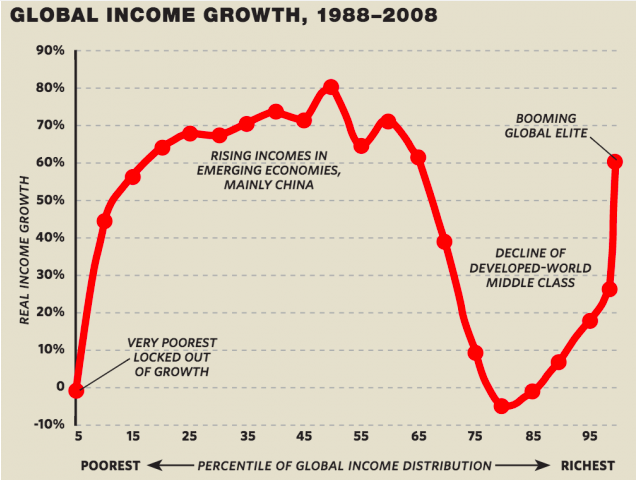

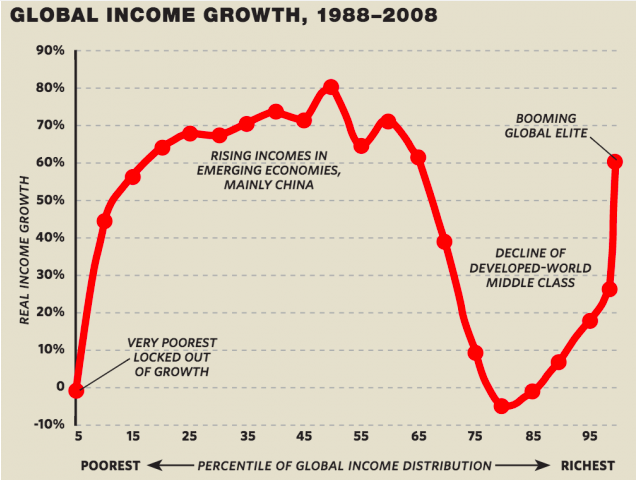

Nice economics book with and on the famous elephant graph showing global income growth 1988-2008:

"Wealth inequality is greater than inequality of income or consumption in almost every country" (p39) The global top 1 percent has 29% of income share, but 46% of wealth share. Piketty is mentioned a few times in this book.

Very good about this book is that it has a very data/evidence-based approach to globalization and its effects. And Milanovic is honest about the consequences: "The reader needs to be constantly aware that globalization is a force both for good and bad" (p30). He ends the book (p239):

And some interesting historic facts on inequality: based on data from Spain from 1280-1850 there is no relationship between mean income (GDP) and income equality. "over the long term, growth does not require rising inequality" (p89).

At the end of the Roman Empire (700 AD), Gini was ~15; incomes were so low, there was no "space" for inequality, there was a common state of poverty. That is also why wars will create equality.

"the Industrial Revolution was similar to a big bang that launched part of mankind onto the path of higher incomes and sustained growth, while the majority stayed where they were, and some even went down. This divergence of paths widened global inequality." (p120).

The Citizenship Premium: "Just by being born in the United States rather than in Congo, a person would multiply her income by 93 times" (p133)

New capitalism:

The rich have influence

Tax less effective in lowering inequality

Migration have an economic net-positive effect

The great winners have been the Asian poor and middle classes; the great losers the lower middle class of the rich world" (p20) (...)

They [globally very rich] too are the winners of globalization, we call them the "global plutocrats". (p22) (...)

44 percent of the absolute gain has gone into the hands of the richest 5 percent of people globally, with almost one-fifth on the total increment received by the top 1 percent (p24)

"Wealth inequality is greater than inequality of income or consumption in almost every country" (p39) The global top 1 percent has 29% of income share, but 46% of wealth share. Piketty is mentioned a few times in this book.

Very good about this book is that it has a very data/evidence-based approach to globalization and its effects. And Milanovic is honest about the consequences: "The reader needs to be constantly aware that globalization is a force both for good and bad" (p30). He ends the book (p239):

Will inequality Disappear as Globalization Continues?

No. The gains from globalization will not be evenly distributed.

And some interesting historic facts on inequality: based on data from Spain from 1280-1850 there is no relationship between mean income (GDP) and income equality. "over the long term, growth does not require rising inequality" (p89).

At the end of the Roman Empire (700 AD), Gini was ~15; incomes were so low, there was no "space" for inequality, there was a common state of poverty. That is also why wars will create equality.

"the Industrial Revolution was similar to a big bang that launched part of mankind onto the path of higher incomes and sustained growth, while the majority stayed where they were, and some even went down. This divergence of paths widened global inequality." (p120).

"in 1820 only 20 percent of global inequality was due to differnce among countries. Most of global inquality (80 percent) resulted from differences within countries; that is, the fact that there were rich and poor people in England, China, Russia, and so on. It was class that mattered. (...)

By the mid-twentieth century, 80 percent of global inequality depended on where one was born (or lived, in the case of migration), and only 20 percent on one's social class. (p128)

The Citizenship Premium: "Just by being born in the United States rather than in Congo, a person would multiply her income by 93 times" (p133)

decision (based on economic criteria alone) about where to migrate will also be influenced by the expectation regarding where he may end up in the recipient country's income distribution, and thus about how unequal the recipient's country's distribution is. Suppose that Sweden and the US have the same mean income. If a potential migrant expects to end up in the bottom part of the country's distribution, then he should migrate to Sweden rather that the US: poor people in Sweden are better of compared to the mean than they are in the US, and the citizenship premium, evaluated in the lower parts of the distribution, is greater. The opposite conclusion follow if he expects to end up in the upper part of the recipient country's distribution: he should then migrate to the US.

This last result has unpleasant implications for rich countries that are more egalitarian: they will tend to attract lower-skilled migrants who generally expect to end up in the bottom parts of the recipient countries' income distributions. (p135)

New capitalism:

"capitalism has moved from being a system with complete separation between capital and labor incomes to a variant where the correlation between the two was negative (those who had labor incomes had very little capital income) to the "new capitalism," where this correlation is positive" (p186).

The rich have influence

Larry Bartels finds that US senators are five to six times more likely to respond to the interests of the rich than to the interests of the middle class. Moreover, Bartels concludes, "there is no discernible evidence that the views of low-income constituents have any effect on their senators' voting"behavior." (p194)

Tax less effective in lowering inequality

Globalization makes increased taxation of the most significant contributor of inequality -namely, capital income- very difficult (p217)

Migration have an economic net-positive effect

International Migration Outlook 2013 (OECD), the most comprehensive study of the costs and benefits of migration in Europe, finds that, on average, an immigrant household contributed €2,000 more in taxes than it received in benefits" (footnote 41, p206)

More...