Take a photo of a barcode or cover

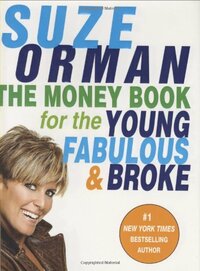

This book provides the best no-nonsense money advice to people in their early 20's. I was feeling overwhelmed with all the information out there concerning what to do with student loans, etc. and this book helped me sort through the information.

I thought this would be the perfect book for me, being young, fabulous, and broke and all. However, I discovered after buying this book that I am not, in fact, broke. Suze Orman's definition of broke (deeply in debt, living paycheck to paycheck) was quite different from mine (low salary). So I feel like the first half of the book didn't apply to me. I really could have used the abridged version. (Or maybe I could have been less stubborn about reading the whole book and skipped over the chapters that didn't apply.)

I have two small criticisms. First, the author's tone grated on me at times. It was a tad bit too condescending and patronizing. Although that might have been my fault since I was reading a book about being broke when I wasn't broke. Second, I wish that Orman would have spent longer talking about buying a house. That chapter didn't seem to break everything down as well as the other chapters did.

That being said, I did learn a lot. Even the parts about credit and getting out of debt might someday be helpful to me. I appreciated that Orman was able to explain financial terms in simple and understandable words.

While I don't feel like this is the end-all, be-all to financial learning, I do think it's a great start. In fact, I wish I had read this book years ago. I would definitely recommend this one to a financial newbie (who's broke).

Four stars.

I have two small criticisms. First, the author's tone grated on me at times. It was a tad bit too condescending and patronizing. Although that might have been my fault since I was reading a book about being broke when I wasn't broke. Second, I wish that Orman would have spent longer talking about buying a house. That chapter didn't seem to break everything down as well as the other chapters did.

That being said, I did learn a lot. Even the parts about credit and getting out of debt might someday be helpful to me. I appreciated that Orman was able to explain financial terms in simple and understandable words.

While I don't feel like this is the end-all, be-all to financial learning, I do think it's a great start. In fact, I wish I had read this book years ago. I would definitely recommend this one to a financial newbie (who's broke).

Four stars.

I liked this book for its ability to point out some basic steps to take to improve my finances. The awareness factor was the big contribution - thinking about financial options that I had shrugged or skipped without thinking about it. The proof will be in the implementation - time will tell.

I desperately needed this book. All the other personal finance books I read focused on people in a financial place I probably won't be for at least a decade, but this is aimed at the just out of college crowd. This helped give me confidence I was on the right track in some areas, and helped me out where I wasn't/was fuzzy. It's fairly basic, but unless your parents thoroughly taught you good financial habits or you learned them in college, it is probably helpful.

As most personal finance books are aimed at people in their 40s and up, I thought I'd look through this to see what it had to offer the under 30 crowd. Personally, it didn't offer anything I hadn't read before (personal finance books all seem to be very repetitive) but it would be a good book for someone who hasn't read a lot on this topic, broke or not.

I skimmed this at my cousin's house and bought it on the way home. My fiance read the whole thing that night.

Obviously, the whole book isn't going to apply to everyone. Personally, I don't have a lot of credit card debt and tend to pay off my cards in full. I do have 30K in student loans that I'm starting to pay off. I also have a Roth IRA that desperately needs money. This book helped me prioritize everything and helped me and my fiance create a plan for paying our bills and saving as much as we can. The website is a helpful tool as well.

She does "allow" the use of credit in a pinch, which is okay, but people our age tend to run with that and define a "pinch" as a great pair of shoes or a new ipod.

Obviously, the whole book isn't going to apply to everyone. Personally, I don't have a lot of credit card debt and tend to pay off my cards in full. I do have 30K in student loans that I'm starting to pay off. I also have a Roth IRA that desperately needs money. This book helped me prioritize everything and helped me and my fiance create a plan for paying our bills and saving as much as we can. The website is a helpful tool as well.

She does "allow" the use of credit in a pinch, which is okay, but people our age tend to run with that and define a "pinch" as a great pair of shoes or a new ipod.

YOU MUST READ THIS BOOK! The beauty of this book is that Suze offers a realistic, easy to understand, practical and useful lesson in personal finance that is targeted to a wide range of people. Whether you are 18-30, have $10K in credit card debt or in a savings account, own or don't own a home, are financially savvy or don't know a thing about finances, this book is fabuous. I consider myself fairly knowledgeable and responsible with money, and I definitely learned a lot. Suze caters to her audience (she even goes against some things I've heard her say on TV, which is great to know what adivce is actually applicable to YOU in your age/situation). She makes a great point that young people have an important tool for building a strong financial future: time. And she shows you how to use it.

Suze has a tone that makes you feel her passion for helping people understand not only the concepts but the reasons behind them. The book is very easy to read. She doesn't preach, she lectures but just enough to make you motivated and not overwhelmed. The best part about the book is that is not only a great reference and will help you on everything from upping your FICO score, to investments to buying a car but the book also has a code in it that allows you to register at a YF&B portion of her website that has tons of tools, calculators and even personal advice once you plug in your info. The code is not unique to each book - I rented this one from the library and the code worked.

No one cares about your money as much as you do. Given how tight things are right now, if you are young and not sure how to set yourself up for the future, it's a great book.

Suze has a tone that makes you feel her passion for helping people understand not only the concepts but the reasons behind them. The book is very easy to read. She doesn't preach, she lectures but just enough to make you motivated and not overwhelmed. The best part about the book is that is not only a great reference and will help you on everything from upping your FICO score, to investments to buying a car but the book also has a code in it that allows you to register at a YF&B portion of her website that has tons of tools, calculators and even personal advice once you plug in your info. The code is not unique to each book - I rented this one from the library and the code worked.

No one cares about your money as much as you do. Given how tight things are right now, if you are young and not sure how to set yourself up for the future, it's a great book.

This right here is the best dang personal finance book I have found. Get your paws on it, even if you're not young or fabulous or broke. But especially do if you are.

It was quite helpful, geared to an audience a little bit older, but I'm glad that I read it now ahead of the game so I kind of know what to expect. Orman does an excellent job of breaking down everything and simplifying all of the previously confusing components of managing your finances. I found out many surprising things and other things that confirmed my knowledge. I will definitely be using this later as a reference, but in the meantime will search for other financial books.

This is a MUST read (or listen, as I did) for anyone beginning their career. I was skeptical about this TV personality, but she knows her stuff and I learned A LOT listening to her. She discusses student loan debt, FICA scores, credit scores, credit card debt, buying a house or car, and investing. Not only does she discuss these topics, but she gives you the run down on exactly HOW to get your FICA scores for FREE. And, she is not a pessimist. So despite large student loan debt, I felt better after listening, not worse. I am better off for listening to this book, and highly recommend for others in the first few years of their careers.