You need to sign in or sign up before continuing.

Take a photo of a barcode or cover

I was looking for a comprehensive financial book that really started at square 1. I wasn't looking to climb out of $100K in credit card debt. Actually, I probably needed a quick debriefing about how credit cards work in general.

It's advanced enough that I could now walk into a bank and handle real-life decisions on my own. But it's beginner enough that I followed it without having any prior experience handling my finances.

It's conversational and easy to follow. It's also very broad, so if you're looking for in-depth reading about how to invest in stocks, that might be another book. Overall, I think Suze (although maybe a little obnoxious on her TV show) comes off very clued-in to the real financial problems of 20-somethings. I will return to this book as a reference guide many times during the next few years.

Now let me go put all of this stellar financial advice to use with my huge $0/month paycheck.

It's advanced enough that I could now walk into a bank and handle real-life decisions on my own. But it's beginner enough that I followed it without having any prior experience handling my finances.

It's conversational and easy to follow. It's also very broad, so if you're looking for in-depth reading about how to invest in stocks, that might be another book. Overall, I think Suze (although maybe a little obnoxious on her TV show) comes off very clued-in to the real financial problems of 20-somethings. I will return to this book as a reference guide many times during the next few years.

Now let me go put all of this stellar financial advice to use with my huge $0/month paycheck.

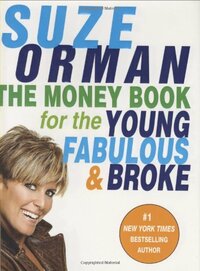

I know it sounds like a total snoozefest, and to be honest I wasn't really thinking I was going to love this book either. But it caught my eye at the library one day because the jacket cover said Suze wasn't going to give a lot of the advice that I dreaded encountering: Save 8 months' expenses, etc. etc. - and a slew of other things 20 somethings living in New York typically just can't do. So, I thought I'd give it a shot, and what better time than when I'm stuck on an airplane for a couple of hours? By the time I landed in Pittsburgh on June 30, I was already halfway through the book and had shoved half a dozen makeshift bookmarks into the pages I found most relevant to my situation.

Here are the things I loved about the book:

1. The book is narrated in a very casual voice, so it's a quick read. Any and all financial terms are explained simply and none of it seemed over my head.

2. Suze takes into consideration many different 20-something financial starting points - are you buried in credit card and/or student loan debt? Have you paid off debts, but you can't save anything? Are you trying to wrap your head around your 401(k)? Do you want to know what it's going to take to get approved for a Mortgage? How about investing in stocks or buying a car? Do you live with a boyfriend/girlfriend/fiance? Whether you need all of this advice or only some of it, it's a great reference to hang onto for a few years. I just skimmed the stuff about cars and houses for future reference, but I read the sections on paying off debt, contributing to my retirement fund, and saving up in detail, for example.

3. The book really isn't preachy except for the stuff about 401(k)s, but that advice is pretty warranted, so just take it with a grain of salt. It helps break down your goals from the point you are at right now, so getting on a better foot financially won't seem like too big of a problem for anyone to tackle.

4. Suze Orman's website has a YF&B section that accompanies the book, and the book has call-outs to point out web tools that can help you with that particular problem. Also, with a special code from the book, you can sign up for a free account wherein you can create your own targeted financial action plan, and read message boards full of advice from Suze and other "YF&Bers".

5. It was published in 2005, so it is still pretty relevant.

Here are the things I loved about the book:

1. The book is narrated in a very casual voice, so it's a quick read. Any and all financial terms are explained simply and none of it seemed over my head.

2. Suze takes into consideration many different 20-something financial starting points - are you buried in credit card and/or student loan debt? Have you paid off debts, but you can't save anything? Are you trying to wrap your head around your 401(k)? Do you want to know what it's going to take to get approved for a Mortgage? How about investing in stocks or buying a car? Do you live with a boyfriend/girlfriend/fiance? Whether you need all of this advice or only some of it, it's a great reference to hang onto for a few years. I just skimmed the stuff about cars and houses for future reference, but I read the sections on paying off debt, contributing to my retirement fund, and saving up in detail, for example.

3. The book really isn't preachy except for the stuff about 401(k)s, but that advice is pretty warranted, so just take it with a grain of salt. It helps break down your goals from the point you are at right now, so getting on a better foot financially won't seem like too big of a problem for anyone to tackle.

4. Suze Orman's website has a YF&B section that accompanies the book, and the book has call-outs to point out web tools that can help you with that particular problem. Also, with a special code from the book, you can sign up for a free account wherein you can create your own targeted financial action plan, and read message boards full of advice from Suze and other "YF&Bers".

5. It was published in 2005, so it is still pretty relevant.

A little dated and sometimes the language is "trying-to-be-hip-with-the-youths," but above all, very valuable information. In most of Suze Orman's other books she doesn't assume the reader's economic status or age, but I liked that this book was clear from the start that this book was for me. Not my favorite of hers (that would either be The Road to Wealth or Women and Money), but the age group and situational subject matter was exactly what I need for right now.

Well, I haven't entirely finished this, but it isn't really the sort of book you need to read all the way through, cover to cover. Orman offers great, down to earth advice for those of us who haven't got a lot of money, but are working and want to prepare for the future. She helps to demystify a lot of the financial market options, and provides the best choice options alongside the less than perfect options.

My mom bought a copy of this book for me years ago, and it is a great resource to refer back to.

I read the first half, which was interesting, but I feel like the second half will be a lot more helpful to me in a couple years.

A little dated but the foundational knowledge was helpful and insightful! Suze Roman has an interesting take on some of the key concerns for those of us that fall in the young and broke category. Not just another money book!

No longer totally relevant after the 2008 recession. However, if you couple it with her 2009 book, The Money Class, the advice seems sound. Just finished paying off my credit card and I feel great about it! Next: my high interest private student loans. Ugh- If only I had found her before I was 18!

Good for what it is. Easy to read and there were a few points that made me think, but I think I am beyond the targeted audience for this book.