Take a photo of a barcode or cover

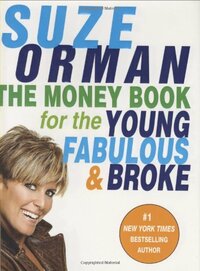

This is a book that I suggest every new employee buy because it breaks down what the hell to do with 401k options if, like me, you didn't want to seem too young and inexperienced to ask. It also has a lot of good information for car purchases, home purchases, and what to do with finances when you get married. I recommend this book to buy now for the investing section and savings section, and keep it on hand for later down the road. Orman is very realistic and gives honest advice that is specifically geared towards people in their 20s.

Well, not SO young. And considering that I go WAY beyond her cost-cutting recommendations, not SO fabulous. But I've got broke down, and some recommendations were pretty good. Probably not as different from standard advice as she claims it is, but there was stuff I had never heard of before.

This book was very informative and educational. Not only do young people need to read this book, older people should read this book as well. It's rich in financial information for every stage in life; from starting off in your career, up until retirement. I wish Ms. Orman could have elaborated more on the types of life insurance polices instead of heavily emphasizing to avoid whole life and cash value policies. Every person should have this book on their shelves or E-Readers.

**11/20/2011: Had a money issue come up and sought this out immediately. The format and index (YAY INDEXING) made it really easy to find the advice that I needed, and it was good advice too!**

Suze Orman, despite whatever shady past and connections she's had, knows how to give great financial advice. I consider myself above-average in financial knowledge, thanks to three business peeps in the family. But this is a GREAT resource for day-to-day financial questions: which bill should I pay first? what are good reasons to spend money? what is the smartest method of saving? Answers abound!

Can't recommend it enough for everyone who has money or doesn't have money. This is on my list of books to buy, it's going to be a great resource.

Suze Orman, despite whatever shady past and connections she's had, knows how to give great financial advice. I consider myself above-average in financial knowledge, thanks to three business peeps in the family. But this is a GREAT resource for day-to-day financial questions: which bill should I pay first? what are good reasons to spend money? what is the smartest method of saving? Answers abound!

Can't recommend it enough for everyone who has money or doesn't have money. This is on my list of books to buy, it's going to be a great resource.

Everyone needs to read this book, especially in today's current economic climate.

A week or two ago I happened to catch Suze Orman on Oprah. Orman had a straight-talk freak-out about the current economic woes, and how individual economic decisions were playing into/creating/contributing to the uncertainty and panic. Her primary message, from the top down, was that everyone needs to put their financial houses in order by being honest about their finances, and reducing our consumption to the level we can actually afford.

I was impressed by her passion in general, and her obvious concern for the viewers she spoke with about their particular financial worries. After years of avoiding her on PBS pledge drive specials, I decided to check out this Suze Orman business.

I checked out her titles online to see if there was a good one to start with, and this title jumped out at me. I'm pushing "young," but I decided that I can just squeak by on that count. I also hoped that I'd be able to get some good information to use with a few of my young coaching clients who are younger and broker than I am. [Feel free to email me if you want more info on coaching.]

So, now to my point. READ THIS BOOK. No, BUY THIS BOOK!! And read it, then re-read it. Keep it on your shelf, and refer to it often. Orman breaks down the steps to financial security step-by-step, and presents the information in clear language anyone can understand.

Whether you're up to your eyeballs in debt, well on your way to fabulous wealth, this book has information you can use.

If you think you're doing okay, I say get this book anyway. life has a way of throwing some curves, and each of us can expect to experience some sort of major life transition, and Orman has created an excellent resource for how we can be ready for the expected and the unexpected.

Did I mention that you should read this book?

A week or two ago I happened to catch Suze Orman on Oprah. Orman had a straight-talk freak-out about the current economic woes, and how individual economic decisions were playing into/creating/contributing to the uncertainty and panic. Her primary message, from the top down, was that everyone needs to put their financial houses in order by being honest about their finances, and reducing our consumption to the level we can actually afford.

I was impressed by her passion in general, and her obvious concern for the viewers she spoke with about their particular financial worries. After years of avoiding her on PBS pledge drive specials, I decided to check out this Suze Orman business.

I checked out her titles online to see if there was a good one to start with, and this title jumped out at me. I'm pushing "young," but I decided that I can just squeak by on that count. I also hoped that I'd be able to get some good information to use with a few of my young coaching clients who are younger and broker than I am. [Feel free to email me if you want more info on coaching.]

So, now to my point. READ THIS BOOK. No, BUY THIS BOOK!! And read it, then re-read it. Keep it on your shelf, and refer to it often. Orman breaks down the steps to financial security step-by-step, and presents the information in clear language anyone can understand.

Whether you're up to your eyeballs in debt, well on your way to fabulous wealth, this book has information you can use.

If you think you're doing okay, I say get this book anyway. life has a way of throwing some curves, and each of us can expect to experience some sort of major life transition, and Orman has created an excellent resource for how we can be ready for the expected and the unexpected.

Did I mention that you should read this book?

Read it. DO IT. Just do it. Information on all those sticky money issues that no one normal understands like mutual funds and 401k(s) and life insurance. And a very informative chapter on navigating finances in a relationship. The checklist in that chapter is a must for anyone in a serious relationship.

This book was not interesting. It straight up wasn't. However, it accomplished what it set out to do: inform millennials how to not go broke, get out of debt, and figure out their finances. Me, I'm terrible at saving money, so this book might just become the best reference I have for the indefinite future. It wasn't written by a stagnant money man. It was written by Suze Orman, who writes straight forward with a bit of cutesy tone. It's incredibly effective, and I'll be forever coming back to this book if I ever need to look up anything related to credit cards, mortgage, or personal budgets. It was written in fall of 2004, so maybe things have changed a bit, but twenty-somethings will always and forever be stupid with money. Thumbs up, Ms. Orman!

I went into a Suze Orman tailspin after reading a recent interview with her on the website The Cut. It was about how she spends her days fishing on an unnamed Island with her wife KT. I read it aloud to my girlfriend as if I were doing a dramatic monologue. The interview is a work of literary genius. It felt like I was reading Hemingway if Hemingway were about sexy happy old rich lesbians.

The Money Book for the Young, Fabulous, and Broke is not a work of literary genius, but it is helpful. I read it because I meet the criteria listed in the title. I'd say it's about 60% percent useful financial advice for the complete (and somewhat irresponsible) novice. Then 30% of the book is just super out of date. Her sunny chapter on home-ownership, for instance, was written during the blissful ignorance of 2006. The final 10% is some real out-of-touch Boomer bullshit that any self-respecting Millennial should steer clear of.

Overall, I'd recommend you just read the interview and maybe check out her podcast.

https://www.thecut.com/2019/03/suze-orman-money-advice-private-island-retirement.html

The Money Book for the Young, Fabulous, and Broke is not a work of literary genius, but it is helpful. I read it because I meet the criteria listed in the title. I'd say it's about 60% percent useful financial advice for the complete (and somewhat irresponsible) novice. Then 30% of the book is just super out of date. Her sunny chapter on home-ownership, for instance, was written during the blissful ignorance of 2006. The final 10% is some real out-of-touch Boomer bullshit that any self-respecting Millennial should steer clear of.

Overall, I'd recommend you just read the interview and maybe check out her podcast.

https://www.thecut.com/2019/03/suze-orman-money-advice-private-island-retirement.html

Not really anything new as far as most financial advice, but if you don't know much at all it will be helpful. Suze makes it fun to read.

This book has the most straight-forward, legitimate advice. I went into it a financial rookie at best, and now I am an expert. I feel prepared to tackle insurance, mortgages, house hunts, car purchases, debt, and retirement after this one book. Now THAT is amazing.